35 Powerful Candlestick Patterns PDF Download - The move of the stock market cannot be predicted. It cannot be told by anyone that in the coming time, in which direction the market will move, but a simple concept of the stock market is based on the fact that history repeats itself and on the basis of this concept the old candle By analyzing the charts, many such patterns have been discovered that act as an indicator for a trader or investor to buy or sell. These patterns formed in the stock market are known as candlestick patterns.

|

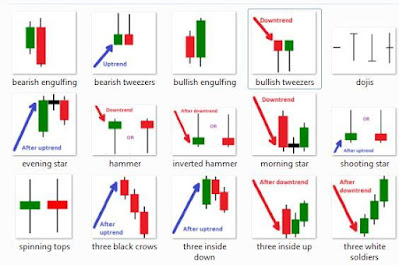

| 35 powerful candlestick patterns pdf |

Have searched about All Candlestick Patterns PDF Download and Chart Patterns PDF and you are disappointed, so you have come to the right place. Know the basics about Candlestick Patterns Book PDF, Japanese Candlestick Charting Techniques PDF, Candlestick Chart Analysis PDF and Candlestick Analysis etc.

In today's article, we will learn about the 35 Powerful Candlestick Patterns that are most commonly formed in the stock market and how these patterns help you in taking your trade, and with this you will also know about these patterns. In this article we are going to discuss about where to put your stop loss.

35 Powerful Candlestick Patterns PDF

There are hundreds of candlestick patterns in the stock market but your job as a trader and investor is that you should know how to trade on these candlestick patterns.

Keeping this in mind, I am providing you All Candlestick Patterns PDF from where you can download Candlestick Patterns PDF for free.

Candlestick Chart Pattern is highly useful in technical analysis. With these Candlestick Patterns, if you have knowledge of Price Action, then you can easily find the best trade for you.

First of all we know how a candle should be understood.

This is a Bullish Candle, because Bullish Candles always open from the bottom and close at the top. Maximum High and Close is the formation of Upper Shadow which is also called as Wick and so is the formation of Lower Shadow between Low and Open.

Note - If You Face Any Problem To Download PDF Then Comment In This Page.

All 35 Powerful Candlestick Patterns PDF

1. Doji

Doji is formed when the opening and closing prices are almost the same.

2. Shooting Star

Shooting Star is a black or white candle with a short body, a long upper shadow, and little or no lower tail

3. Hammer

The hammer is a black or white candle, with a short body on the top with little or no upper shadow and a long lower tail.

4. Morning Star

Morning Star is a Bullish Three Candle Pattern which is formed on the Down Move and on its formation there is a hope that now the market is New Beginning and the market can change the trend.

5. Hanging Man

Hanging Man represents a possible reversal in an uptrend of a stock. Many people believe that the formation of Hanging Man Candle indicates that now the market sentiment has started changing and there is no longer strength in the Uptrend.

6. Three Black Crows

Three Black Crow Pattern is formed during the Uptrend and it makes it likely that Bearish Trend may start now. The hallmark of the Three Black Crow Pattern is that the candle should open below the previous day's open.

7. Inverted Hammer

The Inverted Hammer is a Bullish Reversal Candle that is formed after a long downtrend in the market and is usually taken as a Trend Reversal Signal. Inverted Hammer is formed for any candle whose Open and Close Price is close, that is, if the body is short and the upper shadow is long. Buying Signal is available when Inverted Hammer is made. However, it is considered effective only when the Inverted Hammer is found at the bottom of the candlestick chart or in the Support Zone.

8. Three White Soldiers

The Three White Soldiers Candlestick Pattern is a Bullish Reversal Pattern appearing in the charts of the stock market, usually seen at the end of a downtrend. This pattern is made up of three consecutive green candles, with each candle starting at the high of the previous candle and closing near its high.

This pattern suggests that the Bears are losing control and the Bulls are dominating. This candlestick pattern is used as entry and exit in a share. Investors who have already invested in the shares of a company, they think of exiting after seeing this pattern and those who are planning to invest in the shares of that company, they see this pattern as an investment opportunity.

9. Spinning Top

The Spinning Top Candlestick Pattern is a reversal signal that can be found in both bullish and bearish markets. This pattern is created when the Open, High, and Low are all very close. This candlestick pattern consists of a small body with long wicks on both the sides. Long Wicks show that there was considerable buy-sell pressure during the day, but neither side was able to regain control. This pattern could be a sign that the market is about to reverse.

- 10. Bullish Engulfing

- 11. Bearish Engulfing

- 12. Bearish Harami

- 13. Bullish Harami

- 14. Gravestone Doji

- 15. Bearish Engulfing Pattern

- 16. Marubozu

- 17. Bullish Engulfing Pattern

- 18. Long Legged Doji

- 19. Evening Star Pattern

- 20. Evening Doji Star

- 21. Morning Doji Star

- 22. Harami

Candlestick Patterns Book PDF Download

How To Make Money Trading With Candlestick Charts

This book explains step by step how you can make money by understanding candlestick techniques. You will be told about the major candlestick patterns here, such as how to identify them and how to use them effectively. In addition you will also be guided about the stop loss settings for different candlestick signals to minimize losses. You will get to know about some such trading systems, which will eliminate your emotional interference, panic and greed.

Don't Trade Before Learning These 14 Candlestick Patterns

This book makes it extremely easy for you to learn and practice candlestick trading in no time. This book teaches you the basics to the advanced techniques in candlestick trading. It explains the techniques that will help beginners to learn and experts to make money in Stocks, Indices, Commodities and Forex. The color, size and location of the candlestick body provides you with valuable information about market conditions and the inputs needed for trading decisions and as a result, you are more likely to make your luck in trading.

Japanese Candlestick Charting Techniques PDF

Japanese Candlestick Charting Techniques are a versatile tool for technical analysis and their understanding will be helpful for any technical analyst in analyzing the market. After reading this book, the experienced technical analyst will know how to combine Japanese candlesticks with other technical instruments to create a powerful synergy of techniques. You will find many examples here to explain the concept.

Candlestick Chart Patterns PDF

There are two types of Candlestick Chart Pattern.

1. Bullish Pattern - Through Bullish Pattern, you give an indication of buying in the market.

2. Bearish Pattern - Through the Bearish Pattern, there are signs of selling in the market.

I sincerely hope you have liked 35 powerful candlestick patterns pdf.

Comments

Post a Comment